There was an upward trend in share prices late last week, with better expected next week in the wake of the sharp jump in the gold price after we had closed on Friday. But, as you suggest, before we start trading on Monday we’ll have to absorb the next instalment in our never-ending tax debate. Because Sunday is the day the government unveils the details of its proposed carbon tax.

A tax which might target the mining sector.

Little doubt about that. The major worry for miners is a likely increase in the price of diesel, which the industry uses heavily in mobile fleets and remote area power generation, though we’ll have until what’s been termed “Carbon” Sunday for the detail. At that point the bean-counters will get to work, to tell us what it all means, and how it fits in with that other new tax, the super-tax on mining profits.

The other big news last week was confirmation that the resources sector in this country is being stretched to breaking point, and beyond. Troubles at Murchison Metals (MMX), one of the west coast companies planning to mine, process, rail and ship low-grade magnetite ore, was a timely reminder that cost inflation is accelerating, that infrastructure is not being developed in a timely fashion to handle Asian demand for commodities, and that workers of every sort, from skilled to unskilled, are in alarmingly short supply.

You’re concerned that the Murchison crisis could spill over into other projects?

I don’t see how it can’t, because everyone is in the same boat when it comes to finding people and equipment. Murchison discovered that a project expected to cost around A$4 billion would probably cost more than A$10 billion, which is an impossible undertaking for a company valued on the ASX at A$300 million. Little wonder its share price has crashed from around A$3.00 last year to a closing price on Friday of A69 cents.

But with all that said it was an up week. Overall, the Australian market as measured by the all ordinaries index, rose 1.4 per cent last week, with most of the gain coming on Friday. The metals and mining index did better, putting in a rise of 3.3 per cent, while gold went a step better with a gain of 3.6 per cent.

Right. Let’s move on to prices, starting with the strongest sector, gold.

As mentioned earlier, there were several strong risers among the gold companies. Gryphon Minerals (GRY) was rewarded with a rise of A24 cents to A$2.03 after it reported excellent assays from its Nogbele prospect in Burkina Faso. Best drill hits included eight metres at 38.75 grams of gold a tonne from a depth of 68 metres, and five metres at 17.41 grams per tonne. Mt Isa Metals (MET) joined in with its own discovery news, also in Burkina, reporting on intercepts of four metres at 7.45 grams per tonne, with a core of two metres in that hit grading 14.08 grams per tonne. On the market, the Mt Isa added A8 cents to A39 cents. Ramelius (RMS) was a third significant winner from good gold news, this time on the production side. The company went through the 100,000 ounce a year mark, an event which moved the shares up A12 cents to A$1.37.

Most movement among the rest of the gold companies was up, although there were a handful of declines. Crusader (CAS) rose A9 cents to A$1.27. Tanami (TAM) rose A9 cents to A97 cents. Ampella (AMX) rose A22 cents to A$2.07. OceanaGold (OGC) rose A24 cents to A$2.76. Medusa (MML) rose A63 cents to A$7.11. Integra (IGR) rose A7.5 cents to A50 cents. Silver Lake (SLR) rose A22 cents to A$2.16. And Kingsgate (KCN) rose A51 cents to A$8.44. Companies that were worse off included: Troy (TRY), down A7 cents to A$3.52, AusGold (AUC), down A10 cents to A$1.46, and Reed (RDR), down A3.5 cents to A46.5 cents.

Over to the iron ore sector now please.

Conventional iron ore producers and explorers performed well, though not as well as the gold companies. The unconventional iron ore companies, those focussing on magnetite, did less well, in the face of a potential double hit from the super-profits and carbon taxes. Iron Ore Holdings (IOH) benefited from news that its overall resource had swollen to more than one billion tonnes, helping lift the shares by A5 cents to A$1.41. Amex (XZ) continued its remarkable run by adding another A9 cents to A$1.35 on news that it has received the results of a positive prefeasibility study on its Mba Delta iron sands project in Fiji. Fortescue (FMG) was another mover of note, up A14 cents to A$6.53 as interest grows in its expansion plans. Atlas (AGO) added A13 cents to A$3.90. Iron Road (IRD) put on A4.5 cents to A90 cents, while among the leading magnetite stocks Gindalbie (GBG) crept A1 higher to A82.5 cents, and Grange (GRR) recouped some of its recently lost ground with a rise of A4.5 cents to A56.5 cents.

Base metals next, please, starting with copper.

Strength in the price of copper was only partially reflected in the copper company share prices. Sandfire (SFR) led the way with a rise of A34 cents to A$7.48. Rex (RXM) wasn’t far behind, rising A13 cents to A$2.48. Other companies on the rise included: OZ Minerals (OZL), up A36 cents to A$13.71, PanAust (PNA), up A13 cents to A$4.06, and Anvil (AVM), up A70 cents to A$6.60. Losses were posted by Hot Chili (HCH), down A3.5 cents to A58.5 cents, Resource and Investment (RNI), down A6 cents to A$1.21, and Metminco (MNC), down a fractional half a cent to A30 cents.

Nickel companies continued to firm after a few bad months. Mincor (MCR) recovered another A4.5 cents to A97.5 cents, up considerably on the A82.5 cents price of three weeks ago. Western Areas (WSA) added A31 cents to A$6.05. Independence (IGO) put on A 26 cents to A$5.84. Mirabela (MBN) firmed by A10 cents to A$1.92. Even Minara (MRE) managed a rise of A2 cents to A75 cents, despite an equipment failure at its Murrin Murrin mine which is likely to cut annual nickel output.

Zinc companies also shrugged off a long spell of negative sentiment. Kagara (KZL) gained A6.5 cents to A64.5 cents. Perilya (PEM) put on A2.5 cents to A66 cents. Blackthorn (BTR) rose by A6.5 cents to A51.5 cents. Terramin (TZN) closed the week at A29 cents for a gain of A2 cents, but did trade up to A31.5 cents on Wednesday. Meridian (MII) added A1.9 cents to A11 cents.

The energy stocks next, coal and uranium, please.

All up, in sympathy with the oil price. Best of the coal companies was Coal of Africa (CZA), which rose A18 cents to A$1.29 after it delivered some good news on a South African project.

Yes, we’ll be hearing more on that from John Wallington, the chief executive, on Minesite next week.

Look forward to it. Also on the move in coal was Whitehaven (WHC), up A28 cents to A$6.08. Metro Coal (MTE) rose A12 cents to A70 cents. Carabella (CLR) rose A19 cents to A$1.99, and Bathurst (BTU) rose A9 cents to A$1.11.

Those coal rises would appear to indicate that the carbon tax isn’t seen as too much of a worry?

Or that investors are looking through the tax and seeing a change of government, caused to some extent by the introduction of these unpopular taxes. Whatever the reason, the market has redeveloped a taste for energy companies. That was evident too in the continued rebound among the uranium explorers. Bannerman (BMN) was the star in the uranium space last week, adding A10 cents (35 per cent) to A38.5 cents. Forte (FTE) gained A1.6 cents to A7.6 cents. Berkeley (BKY) rose by A5 cents to A44 cents. Deep Yellow (DYL) had its best week for some time, with a gain of A3 cents to A19 cents, and Aura (AEE) gained A2.5 cents to A27 cents.

Minor metals to close, please.

Rare earths led the way among the more exotic mineral commodities. Lynas (LYC) announced a joint venture with Germany’s Siemens to produce high-strength magnets and its shares moved strongly as a result, closing A26 cents higher at A$2.01. Alkane (ALK) added A10 cents to A$2.28, and Arafura (ARU) put on A5.5 cents to A80 cents.

Potash companies rose marginally. South Boulder (STB) rose A12 cents to A$2.49, and Minemakers (MAK) added A3 cents to A47 cents.

Lithium companies weakened. Galaxy (GXY) fell A3 cents to A75 cents, and Orocobre (ORE) by A1 cent to A$2.08 cents.

Source

Australian markets performed over the past week

Diposting oleh jim | 21.30 | Commodity, Company, finance/investment, market, News, stock | 0 komentar »Canadian markets performed over the past week

Diposting oleh jim | 19.04 | Commodity, Company, finance/investment, market, News, stock | 0 komentar »Poor job numbers out of the United States prompted a sell-off in equities on Friday but for the most part it was a good week for the resource-related companies. Once all the trading was done, the TSX Ventures Exchange, home to more junior exploration companies than anywhere else in the world, had added 4.23 per cent, while the TSX Gold Index had tacked on 2.64 per cent.

Let’s start off with the exploration news out of the Yukon.

Well, the 2011 field season in Canada’s Yukon is starting out on a solid footing and delivering favourable drill results on multiple fronts. Atac Resources led the charge by tabling results from work on the Conrad zone within the Nadaleen Trend in central Yukon. In 2010 the company drilled a discovery hole which hit 21.13 metres grading 8.03 grams gold per tonne. The first 2011 hole was drilled 100 metres east of this and hit 114.93 metres of 3.15 grams gold per tonne. Atac ended the week at C$8.70 for a C$1.40 gain.

And good news for Atac also means good news for Strategic Metals, which at last count held nearly 10 million Atac shares. The Yukon project generator closed up C$0.45 at C$3.60.

Positive stuff! Anyone else delivering good news in the Yukon?

Yup. Golden Predator released results from the final five holes from its winter 2011 drill program at the Carlos zone on the Grew Creek project. Highlights included 92 metres running 2.02 grams gold per tonne and 104.2 metres of 1.68 grams gold per tonne. Golden Predator closed out the week up C$0.03 at C$0.99.

And shares of another Yukon market darling performed well on no new results. Kaminak Gold added C$0.43 to close at C$4.18 as investors buy ahead of more drill results from its Coffee project.

So, what’s happening among the producers?

Shares of Sandstorm Gold added C$0.16 to close at C$1.35 in the wake of good operational news from Luna Gold’s Aurizona mine in Brazil. Sandstorm has an agreement to purchase 17 per cent of the life-of-mine gold production from Aurizona.

Elsewhere, Avion Gold announced production results from its Tabakoto/Segala operations in Mali. The company produced 25,823 ounces during the second quarter, putting it on track for 100,000 ounces in 2011. Avion ended the week up C$0.24 at C$2.18.

Also in production news, Kirkland Lake Gold tabled quarterly production of 24,566 ounces of gold and record yearly production of 81,860 ounces of gold from its operation in Ontario. Operating costs have dropped to US$759 per ounce from US$1,045 per ounce a year earlier. Kirkland ended the week up C$1.50 at C$16.70.

Meanwhile, First Quantum Minerals said it produced of 64,500 tonnes of copper and 40,700 ounces of gold during the second quarter. This was lower than expected. First Quantum ended the week down C$4.42 at C$136.20.

Capstone Mining produced 21.2 million pounds of copper in concentrates in the second quarter from its Cozamin operation in Mexico and from its Minto mine in Yukon. Capstone ended the week up C$0.08 at C$3.67.

Back with exploration, but staying with copper, Duluth Metals continued to table the goodies from its Twin Metals Nokomis deposit in Minnesota. Highlights included 185 feet of 1.92% copper equivalent. Duluth ended the week up C$0.16 at C$2.54.

It was a good week for shareholders of European Goldfields. The company will now get its Greek mining permit this month after a very long wait. The environmental impact studies for the Olympias polymetallic and Skouries gold-copper projects on Greece’s Halkidiki peninsula have been on the table for several years. European Goldfields closed up C$3.55 at C$13.65.

China raised interest rates, the jobless rate in the United States climbed to 9.2 per cent and a report circulated that underwater rare earth deposits have been discovered by Japanese scientists. A mixed bag of news if there was one. For speculative investors all eyes are on drill results and nothing else. We will see what next week has in store.

Source

Spot gold and Spot silver are stable

Diposting oleh jim | 22.42 | Commodity, finance/investment, Gold, market, Metals, Silver | 0 komentar »Spot gold is relatively stable on Monday, after slipping nearly 1 percent in the previous session, while the dollar mixed - down against the euro but rose versus some other currencies, and holidays in Australia, is expected to create anxiety in the trade.

FUNDAMENTALS

* Spot gold fell 4 cents to $1,530.99 an ounce by 0118 GMT, after ending last week half a percent lower.

* U.S. gold edged up 0.2 percent to $1,532.30.

* The dollar fell 0.1 percent versus the dollar, by rose 0.05 percent against a currency basket .DXY.

* Bullion came under pressure after Wall Street resumed its slide following weaker Chinese trade data last week..N

* More data is scheduled to be released from the world's top gold producer, including inflation where the market expects a small rise to 5.4 percent in consumer prices.

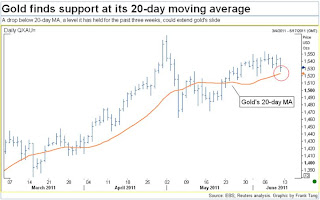

* Support for gold was seen at its 20-day moving average of $1,524, a level it has held for the past three weeks.

* Silver rose 0.2 percent to $36.21 after slipping more than 3 percent on Friday.

Precious metals prices 0118 GMT

Metal Last Change Pct chg YTD pct chg Volume

Spot Gold 1530.99 -0.04 -0.00 7.86

Spot Silver 36.21 0.08 +0.22 17.34

Spot Platinum 1825.24 1.49 +0.08 3.27

Spot Palladium 811.75 1.80 +0.22 1.53

TOCOM Gold 3972.00 -8.00 -0.20 6.52 30344

TOCOM Platinum 4772.00 -3.00 -0.06 1.62 3269

TOCOM Silver 93.90 -2.40 -2.49 15.93 650

TOCOM Palladium 2108.00 13.00 +0.62 0.52 149

COMEX GOLD AUG1 1532.30 3.10 +0.20 7.80 3704

COMEX SILVER JUL1 36.24 -0.09 -0.25 17.11 6724

Euro/Dollar 1.4337

Dollar/Yen 80.50

TOCOM prices in yen per gram. Spot prices in $ per ounce.

COMEX gold and silver contracts show the most active months

Source

London's markets performed over the last week

Diposting oleh jim | 08.35 | Commodity, Company, finance/investment, market, News, stock | 0 komentar »Equities lacked clear direction in a week which was decidedly mixed as far as commodities were concerned. On the bigger stage traders continued to fret over the state of the global economy. Even so, gold edged lower to US$1,532 per ounce while silver held firm at US$36 per ounce. Platinum fared better, rising to US$1,828 per ounce, and palladium climbed to US$813 per ounce. Copper slipped to US$9,016 per tonne, or US$4.09 per pound, while nickel reversed its downward trend to climb to US$22,905 per tonne. Zinc also strengthened, rising to US$2,272 per tonne.

Amongst the majors, Xstrata slipped 2.2 per cent to 1,333p, Rio Tinto edged higher to 4,111p, BHP Billiton rose to 2,308p and Anglo American rose to 2,946p. Commodities trader Glencore climbed 2.1 per cent to 516p. Two miners resumed operations after resolving labour disputes. Following the dismissal of workers taking industrial action at its Karee operations, platinum miner Lonmin has largely completed the recruitment of replacements. Production at Karee has now resumed and is ramping up, although management estimates that full-year sales will be around 30,000 ounces lower than previous guidance. Sales for the year to September are now expected to total around 720,000 platinum ounces. Lonmin’s shares closed 7.4 per cent lower at 1,460p.

Cluff Gold also successfully resolved a labour dispute. Normal operations have resumed at the company’s Kalsaka mine in Burkina Faso. The company also stated that the disruptions have not affected the company’s production guidance of 70,000 ounces from Kalsaka in 2011. The shares recovered 12.7 per cent to 95.75p.

And in a dispute of a different kind, in the boardroom, the murky tale of ENRC continues. ENRC lost a lot of friends when it sided with the Congolese government in the sequestration of the Kolwezi tailings project from First Quantum. That prompted a US$2 billion lawsuit from First Quantum, which is pursuing the case from the safety of the British Virgin Islands. Most recently, two independent non-executives have been voted off the board, exacerbating a sense of unease in the market about the company’s corporate governance. The stock exchange said that the company was not in breach of any rules, but the uncertainty continued on Sunday as a report that Glencore was considering making a takeover offer appeared in the papers. ENRC shares dropped by more than 50p to 742p.

In gold exploration, Patagonia Gold provided a positive update from its Monte Leon gold-silver prospect in Santa Cruz province, Argentina, where drilling has intersected wide, near-surface zones of potentially bulk mineable gold and silver over a strike length of one kilometre. Markets wanted more, though and the shares slipped 7.5 per cent to 40.25p.

In Ghana, Goldplat published a technical report on its recently acquired Banka project in the Ashanti gold belt. The report suggests that Banka offers significant potential for an upgrade to the current non-JORC compliant resource of 262,107 ounces of gold. The shares closed 3.3 per cent lower at 11p.

In South Africa, Pan African Resources announced encouraging results from drilling the at Bramber tailings dam at the company’s Barberton operation. If viable, production from tailings could increase output from Barberton by 20,000 ounces per annum, which should lift total output comfortably above 100,000 ounces. The shares stayed firm at 10.75p.

Away from gold, uranium investor Kalahari Minerals announced a resource update for the Husab uranium project in Namibia in which it holds a 42.76 per cent interest via an investment in Extract. The total resource has increased 33 per cent to over 500 million pounds of U3O8, and Husab is now recognised as the world’s fourth largest uranium deposit. The shares edged higher to 234p.

The challenges continue for African Barrick Gold. Just weeks after its North Mara mine in Tanzania was attacked by 800 intruders in an assault that left seven intruders dead, the company has had to refute media reports that Tanzania is to impose a mining super profits tax similar to that proposed in Australia. The company asserted that its mineral development agreements cannot be amended without its agreement, although the market wasn’t convinced and the shares closed nine per cent lower at 411p.

Another miner facing potentially heightened political risk is Minera IRL, whose operations in Peru could be vulnerable should the newly-elected leftist government decide to impose populist policies. The market was relaxed about the threat, though, and the shares strengthened 2.2 per cent to 71p.

EMED Mining has long suffered government delays to the planned reopening of the Rio Tinto copper mine in Spain. Nevertheless, detailed geological investigations have identified significant underground mining potential for the project once it does get up and running. The shares closed 3.3 per cent lower at 10.4p.

The week's political challenges didn’t deter two miners from floating on the Alternative investment market. First came Strategic Minerals, which raised £750,000 through a placing at 5p to fund the next phase of exploration at its magnetite iron ore exploration project in northeast Queensland, Australia. Then on Friday, Touchstone Gold raised £10 million through a placing at 27p to fund exploration and development at its Rio Pescado project in Colombia. Strategic Minerals closed the week at 12p and Touchstone Gold at 30.9p.

However, it wasn’t all good news on the fundraising front as Nautilus Minerals was forced to abandon its substantial Canadian fundraising as a result of poor market conditions. The company remains debt-free and holds cash of US$139 million as it works to bring its first sub-sea project to completion. The shares slumped 18 per cent to 135p.

Several miners were on the acquisition trail, including Sable Mining Africa, which acquired a 49 per cent interest in the Lubimbi coal project in Zimbabwe. Historical work here has indicated an in-situ resource in excess of one billion tonnes and the company is planning an immediate exploration and development programme. The shares slipped 1.3 per cent to 19.75p.

Meanwhile, coloured stones specialist Gemfields entered into a conditional agreement to acquire a 75 per cent interest in a ruby deposit based in the Cabo Delgado province in Mozambique. The consideration of US$2.5 million will be paid in stages. Gemfields shares gained 1.4 per cent to 17.75p.

In South America, Orosur Mining has entered into an agreement to acquire a 100 per cent interest in the Talca gold property in Chile for a phased consideration of US$7.6 million. Orosur also announced a US$13.5 million placing at 66p a share. The shares slipped 0.5 per cent lower to 70.63p.

Finally, GGG Resources gained 7.1 per cent to 26.13p after it extended the closing date its off-market takeover offer for partner Auzex Resources until 4 July 2011.

Source

Australian markets performed over the last week

Diposting oleh jim | 08.23 | Commodity, Company, finance/investment, market, News, stock | 0 komentar »The slide in share prices we’ve seen over May and June has been more like a slow melting process, as each week has produced slightly lower numbers. The outlook for next week is not much better, given that the Dow Jones index on Wall Street closed below 12,000 points for the first time since March.

All of the key indices on the ASX lost ground last week, but not substantially. The all ordinaries index had four modestly down days and one up, to shed a relatively painless 0.7 per cent overall. The metals and mining index did even better, losing just 0.5 per cent, while the gold index suffered the biggest decline, at 2.3 per cent, though that didn’t tell the whole story because a reasonable number of gold companies also rose.

Shall we start with gold, then? Because while the world worries, gold often performs at its best.

There two things that are more certain than gold: death and taxes, and the issue of taxes was again in the news this week. The Australian Government seems to have two tax surprises in store. The resource rent, or super-tax, has reached the draft legislation phase with the release of a review which, surprise-surprise, further complicates an already complex proposal. What the government wants to do is force miners to value individual mining leases inside their projects. Naturally, some of those leases will be of lesser value because they contain less ore. The upshot is expected to be a decline in allowable depreciation and an increase in tax.

How horribly convoluted.

Couldn’t agree more, but it’s an indication of the determination of the government to tax anything that moves, or burns, because the new carbon tax is also moving down the legislation runway, speeding up to catch the coal miners. Until now, the coal companies thought they would get a reprieve for being exporters. Not so. So from next year, or the year after, coal companies will have two new taxes to contend with, the resources super tax and a carbon tax.

Enough boring tax talk. Let’s have some prices.

We’ll start with gold, but also toss in a few of the outperformers in other sectors to provide our readers with a few fresh names. Best of the gold explorers was one we’ve never heard of before, Alloy Resources (AYR). It doubled in price last week, rising from A3.2 cents to a peak on Thursday of A7.6 cents in massive turnover. More than 113 million shares changed hands on the day, out of an issued capital of 146 million shares. Sanity returned on Friday and Alloy closed at A5.9 cents for a gain over the week of A2.7 cents, or 84 per cent. Driving the shares was a fresh gold discovery called Warmblood at the company’s Horsewell project in Western Australia. Best intersection was 32 metres at 3.9 grams a tonne from the surface, and 8 metres at 4.4 grams per tonne from 12metres.

Nor particularly high grades, but presumably they link up with earlier drill results.

That seems to be the theory. By the way, Alloy’s chairman is a well-known mining character down this way, Peter Harold, chief executive of the nickel miner, Panoramic.

Let’s keep going with prices please.

Also up in a down week was Troy Resources (TRY) which is showing the benefits of a management marketing tour of North America. It added A21 cents to A$3.68. Azumah (AZM), one of the Aussie gold companies busy in West Africa which we took a look at last week, added A3.5 cents to A56 cents. Allied Gold (ALD) continued to recover lost ground, putting in a rise of A4 cents to A55 cents. Kingsgate (KCN) released an optimistic production forecast and was rewarded with a share price rise of A57 cents to A$8.20. Ausgold (AUC), the company which thinks it is on to something big near the wheat-belt town of Katanning in WA, rose by A10 cents to A$1.48, and might be worth a site visit soon.

Among the other gold movers was Beadell (BDR), up 1.5 cents to A80 cents. St Barbara (SBM) rose A3 cents to A$1.85, while its takeover target, Catalpa (CAH) was steady at A$1.72. Perseus (PRU) posted one of the biggest falls of the week, shedding A21 cents to A$2.36. Crusader (CAS) was also sold off quite heavily, losing A20 cents to A$1.00. After that most falls were modest. Kingsrose (KRM) lost A6 cents to A$1.37. Silver Lake (SLR) slipped A4 cents lower to A$1.67, and Adamus (ADU) eased back by A3 cents to A60 cents.

Iron ore next, because there seems to have been a bit of action there.

Territory (TTY) was the star of the week as its long-term trading partner, Noble Group from Hong Kong, weighed in with an all cash A50 cent-a-share bid to try and knock South Africa’s Exarro out of contention. On the market, Territory added A5.5 cents to A52 cents, a price which indicates that some investors expect Exarro to counter bid. Elsewhere, Atlas (AGO) rose by A7 cents to A$3.65. Haranga (HAR), a company we rarely hear anything about, attracted interest with a rise of A4 cents to A30 cents as its makes progress at its Mongolian iron ore exploration projects. After that most moves were minor. Fortescue Metals (FMG) slipped A14 cents lower to A$6.32. Mt Gibson (MGX) shed A2 cents to A$1.76. Gindalbie (GBG) lost A4.5 cents to A89 cents, and Sherwin (SHD) was A1 cent lighter at A14 cents.

The base metals next, starting with copper, please.

A mixed bag, but without any significant moves up, or down. Sandfire (SFR), which is worth a closer look next week, added A16 cents to A$7.17, as investors continue to digest its very positive feasibility study into the DeGrussa project. OZ Minerals (OZL), Sandfire’s biggest shareholder, added A7 cents to A$13.70. Anvil (AVM) was one of the only other copper companies to rise, putting on A5 cents to A$5.67. After that came a list of declines. PanAust (PNA) lost A4 cents to A$3.77. Rex (RXM) was down A14 cents to A$2.52. Metminco (MNC) dropped a fairly sharp A6.5 cents to A30 cents, and Hot Chili (HCH) was A2 cents weaker at A58 cents.

All nickel companies lost ground. Most zinc companies rose, marginally. Among the nickels Mincor (MCR) fell by A10 cents to A89 cents. Panoramic (PAN) was A4 cents weaker at A$1.79, and Western Areas (WSA) fell by the same amount, A4 cents, to A$5.99. Best of the zinc companies was Perilya (PEM) which rose by A1.5 cents to A66 cents. Blackthorn (BTR) gained A1 cent to A53 cents, and Ironbark (IBG) firmed by A2 cents to A29 cents.

Coal and uranium next.

There were only a few risers, but lots of fallers. Whitehaven (WHC) was the lone coal company to rise, just. It added A8 cents to A$5.59. Falls were posted by Aquila (AQA), down A42 cents to A$7.75 as it continues to have joint venture problems, Coal of Africa (CZA), down A1 cent to A$1.16, Carabella (CLR), down A8 cents to A$1.96, and Coalworks (CWK), down A6.5 cents to A65 cents.

The three uranium companies rise were Extract (EXT) which added A3 cents to A$7.79, Berkeley (BKY) which rose by A5 cents to A44 cents, and Forte (FTE), perhaps thanks to our midweek report, which managed a rise of A0.4 of a cent to A7.2 cents. Then come the falls, led by Paladin (PDN) which was hit by rumours about funding issues, and which dropped A24 cents to A$2.79 on the week, but did get as low as A$2.68 at one stage on Thursday. Bannerman (BMN) lost A1 cent to A29.5 cents. Toro (TOE), sold down to A7.6 cents, off by A0.7 of a cent, and Energy and Minerals (EMA) fell by A2 cents to A13.5 cents after reporting fresh legal problems.

Minor metals to close, please.

Much like the rest of the market. A handful of rises and plenty of small falls. Alkane (ALK) was the pick of the rare earth companies, putting in a rise of A30 cents to A$2.35. Iluka (ILU) was in demand thanks to sky-high zircon prices. It added A$1.64 to A$17.49. Lithium stocks firmed. Galaxy (GXY) put on A1.5 cents to A86 cents, and Orocobre (ORE) added A3 cents to A$2.18. Potash stocks weakened. South Boulder (STB) fell A2 cents to A$3.13 and Minemakers (MAK) was off by A1 cent to A45 cents. Biggest fall of the week was freshly listed Kimberley Rare Earths (KRE) which dropped A4.5 cents to A16.5 cents after being stopped from completing a related party asset purchase ASX regulators.

Source

Canadian markets performed over the last week

Diposting oleh jim | 08.16 | Commodity, Company, finance/investment, market, News, stock | 0 komentar »The summer doldrums have hit the resource-rich Canadian markets, and a notable lack of buying interest has caused the broader markets to decline on weak volumes. And the critical game six of the Stanley Cup finals to be held in Vancouver on Friday also seemed to have many investors focussed on hockey rather than money. Once all the trading was done this past week, the TSX Ventures Exchange, home to more junior exploration companies than anywhere else in the world, had dropped 5.87 per cent, while the TSX Gold Index had fallen 4.84 per cent.

Let’s start off with the political news out of Peru and how that impacted the Canadian-listed companies working there.

Righto. The presidential election victory went to leftist candidate Ollanta Humala and that sparked renewed concerns that mining taxes will be raised and that the government may take control of the country’s natural resources.

As we said in our article earlier in the week.

Precisely. Since then companies operating in Peru, along with Humala himself have attempted to reassure investors that the concerns are overdone. But there were still plenty of fallers come the end of the week. Candente Copper lost C$0.17 to close at C$1.39, Sulliden Gold dropped C$0.27 to C$1.90 and Bear Creek Mining fell C$1.15 to C$5.05.

What’s been going on elsewhere?

Drilling news produced mixed results, depending on the whims of the market. Kaminak Gold tabled the first set of results from its highly anticipated drill program on the Coffee project in the Yukon’s White Gold district. Despite cutting 27 metre of 2.5 grams gold per tonne and 10.4 grams gold per tonne over six metres, investors were unimpressed because Kaminak ended the week down C$0.22 at C$3.31.

But B2Gold prompted some buying after the company announced results from its newly discovered Cebollati gold property in Uruguay. Highlights included 2.2 metres of 23.61 grams gold per tonne. B2Gold closed at C$3.68 for a C$0.42 gain.

However, despite cutting 112.9 metres of 2.51 grams gold per tonne at its Ana Paula project in Mexico, shares of Newstrike Capital lost C$0.20 to close at C$1.85.

And Avion Gold continues to hit the goodies at the Vindaloo zone at its Hounde project in Burkina Faso. The latest results included 32 metres running 11.48 grams gold per tonne. Avion ended the week up C$0.11 at C$1.64.

Duluth Metals tagged 34.5 feet averaging 2.82% copper equivalent from its Nokomisdeposit in Minnesota. Duluth ended the week up C$0.04 at C$2.21.

Trade Winds Ventures tabled a drill intercept of 4.37 grams gold per tonne over 15 metres at its 50 per cent owned Block A joint venture project in northeastern Ontario. Not good enough in a down market, though, because Trade Winds closed at C$0.22 for a C$0.025 loss.

Anybody putting out financials?

Minera Andes managed to table earnings of $17 million, or $0.06 per share, for the three months ended March 31st, 2011. The company’s 49 per cent owned San Jose mine in Chile produced 18,000 ounces of gold and just over 1.34 million ounces of silver. For the week, Minera Andes lost C$0.11 at C$2.29.

On the diamond front, higher prices for rough diamonds propelled Harry Winston Diamond to first quarter earnings of US$3.6 million, up from US$2.9 million in the same three month period a year earlier. Harry Winston ended the week down C$0.04 at C$16.

There was also a bit of a legal spat as Barrick Gold took on Goldcorp, New Gold and Xstrata over Goldcorp's purchase of Xstrata's 70 per cent interest in the El Morro project and its subsequent sale to New Gold. Barrick claims that the deal with Goldcorp breached El Morro shareholders' agreement and is now going to trial in Ontario’s Superior Court. Barrick is looking either to regain the 70 per cent stake in the project or to get financial compensation for economic damages. Barrick ended the week down C$2.25 at C$42.62, Goldcorp fell C$1.78 to close at C$46.20 and New Gold dropped C$0.52 to close at C$8.99.

The job market in Canada has shown some improvement but all eyes are on the end of quantitative easing by the United States Federal Reserve as of June 30th. The stopping of the printing presses is widely expected to impact commodity prices and not in a good way. We will see what next week has in store.

Source