RIO Tinto will invest $C10 million ($10.1m) into a new underground research centre in Canada in an expansion of its global program.

As part of Rio’s global program, Mine of the Future, the mining giant plans to conduct a full-scale performance-verification trial in 2012 at its Northparkes, NSW copper and gold mine.

The trial in NSW will be the first of three new underground excavation systems.

Rio’s spend in Canada follows a $C10 billion commitment to the country by Brazil’s Vale, a week after BHP Billiton officially pulled its $40bn hostile bid for Potash Corporation of Saskatchewan.

The $C10m outlay in Canada will be invested over five years, which Rio said would complete a suite of five global long-term Rio Tinto research centres.

Start of sidebar. Skip to end of sidebar.

End of sidebar. Return to start of sidebar.

Rio Tinto also has research centres in Sydney, Perth, Queensland and London.

“In order to satisfy the global demand for minerals, we will need to go deeper to access new resources,” said Rio’s head of innovation, John McGagh.

“There is no other mining operation in the world attempting to take the approach that we are on this scale.”

The new Canadian Centre for Underground Mine Construction will be based at the Centre for Excellence in Mining Innovation in Sudbury, Ontario. Rio said the centre would focus on innovative rapid mine construction and ground control for mining at depth.

The global mining major said the work at the Canadian centre would assist its development of new excavation systems through The Mine of the Future program, which focuses on improving the construction and operation of underground mines.

source

Rio Tinto invests in Canadian underground research centre

Diposting oleh jim | 23.55 | Company, News | 0 komentar »Asian Stocks Drop a result of warming temperatures on the Korean peninsula

Diposting oleh jim | 23.09 | News | 0 komentar »Asian stocks fell, driving the region’s benchmark index toward its biggest loss in two weeks, as North Korea’s state news agency warned its confrontation with South Korea could lead to war, and on concern that China will tighten monetary policy.

Hana Financial Group Inc., South Korea’s fourth-largest financial company slumped 4.1 percent in Seoul following the resignation of South Korea’s defense minister and after having its investment rating cut. Industrial & Commercial Bank of China Ltd. lost 1.6 percent in Shanghai after the Shanghai Securities News said the government may cut the target for new lending next year. Rio Tinto Group, the world’s third-biggest mining company, climbed 1.2 percent in Sydney after metal prices advanced in London.

“Markets are factoring in the likelihood of some sort of additional action by the North Koreans,” said Tim Schroeders, who helps manage about $1 billion at Pengana Capital Ltd. in Melbourne. “What was initially dismissed as a one-off skirmish is now making people a little bit nervous.”

The MSCI Asia Pacific Index dropped 1.2 percent to 129.10 as of 7:26 p.m. in Tokyo, with two stocks dropping for each that advanced. The gauge rose 0.2 percent yesterday after reports showed that U.S. employment and consumer sentiment improved.

The measure is headed for its third straight weekly decline, the longest run of weekly losses since February. The Asia Pacific Index fell 3.5 percent from a two-year high on Nov. 8 through yesterday on speculation China will take further steps to tame inflation and on concern that a debt crisis in Europe will spread.

‘Escalated Confrontation’

South Korea’s Kospi Index slumped 1.3 percent as North Korea warned that any “escalated confrontation” will lead to war, according to state news agency KCNA. The North is “greatly enraged at the provocation” from South Korea and it will retaliate to any encroachment of its sovereignty, the agency said in a statement e-mailed to news organizations.

South Korea may appoint a new defense minister today after Kim Tae Young resigned in the wake of North Korea firing artillery onto the South’s territory for the first time in half a century this week. President Barack Obama sent a nuclear- powered aircraft carrier, USS George Washington, to the area for joint drills with South Korea between Nov. 28 and Dec. 1.

Australia’s S&P/ASX 200 Index added 0.1 percent in Sydney, the only major index in the region to advance today. Hong Kong’s Hang Seng Index dropped 0.8 percent and the Shanghai Composite Index slipped 0.9 percent. Japan’s Nikkei 225 Stock Average retreated 0.4 percent.

Financial Stability

Futures on the Standard & Poor’s 500 Index fell 0.7 percent today. U.S. markets were closed yesterday for the Thanksgiving holiday.

The benchmark Stoxx Europe 600 Index rose 0.5 percent yesterday after German central bank President Axel Weber said a rescue fund for the euro area would be sufficient to calm financial markets. Weber, who is also a European Central Bank Governing Council member, said governments can increase the size of the European Union-led bailout fund if necessary to restore confidence in the euro.

“Investors globally welcome any moves by governments to support each other,” said Angus Gluskie, who manages about $350 million at White Funds Management Pty in Sydney. “The euro issues pose a threat to the stability of financial institutions globally.”

The MSCI Asia Pacific Index increased 8.4 percent this year through yesterday, compared with 5.5 percent for the Stoxx Europe 600 Index and 7.5 percent for the S&P 500. Stocks in the Asian benchmark are valued at 14.4 times estimated earnings on average, compared with 12 times for the Stoxx 600 and 14.1 times for the S&P 500.

Hana, LG, Hyundai

Hana Financial Group Inc. slumped 4.1 percent to 37,400 won in Seoul. The stock was cut to “neutral” from “outperform” at Macquarie Group Ltd., which said the company doesn’t have excess capital after buying a controlling stake in Korea Exchange Bank.

Hyundai Motor Co., South Korea’s largest automaker, dropped 1.4 percent to 175,000 won. LG Display Co., the world’s second- largest maker of liquid-crystal displays, sank 2.3 percent to 40,850 won.

“Right now, the big issue is North Korea,” said Kim Young Chan, a fund manager at Shinhan BNP Paribas Asset Management Co., which oversees $28 billion. “There are risks remaining such as the planned military drill, and there are jitters about that, especially because stocks aren’t down enough to price that in.”

Industrial & Commercial Bank lost 1.6 percent to 4.32 yuan in Shanghai. China Construction Bank Corp. dropped 1.5 percent to 4.68 yuan. Developers China Vanke Co. and Poly Real Estate Group Co. also fell.

China Interest Rates

Chinese policy makers have been stepping up measures in recent weeks to curb inflation that reached 4.4 percent last month, the fastest pace in two years. National Development and Reform Commission, the nation’s top planning body, urged local governments to be careful about introducing price increases, according to a statement on the commission’s website yesterday.

“The market is still rife with concerns about policy tightening,” said Li Jun, a strategist at Central China Securities Co. in Shanghai. “The central bank had made it clear that it will use price tools to manage inflation expectations. That means another interest rate increase will come soon.”

Rio advanced 1.2 percent to A$84.04 in Sydney after a measure of metals traded in London rose 1.4 percent yesterday following Weber’s comments. Copper advanced 1.1 percent, zinc 3.4 percent, and nickel 1.4 percent. Woodside Petroleum Ltd., Australia’s No. 2 oil and gas producer, climbed 0.7 percent to A$40.95 as crude oil prices increased in New York yesterday.

Among other stocks that fell today, Aristocrat Leisure Ltd., the world’s second-largest maker of slot machines, tumbled 19 percent to A$2.70 in Sydney after saying earnings may drop as much as 57 percent on lower sales and gains by the Australian dollar.

source

Indian gold traders stepped back from the markets

Diposting oleh jim | 21.54 | Gold, market, News | 0 komentar »India gold traders stayed away on Friday afternoon, as a weaker rupee made the dollar-quoted yellow metal expensive, dealers said.

"I have done minimal deals from morning as even the rupee is not in supporting mode," said a dealer with a state-run bank in Mumbai, which imports bullion.

The most-active gold contract MAUc1 edged higher by 0.20 percent higher at 20,406 rupees per 10 grams at 2:00 p.m., helped by a weak rupee. The contract had struck an intra-day high of 20,412 rupees earlier in the session.

"If gold breaches below 20,000 rupees, we may see some buying interest," said another dealer with a private bullion importing bank.

The Indian rupee extended its fall to 10-week lows tracking a more than 1 percent drop in domestic shares while bunched up dollar demand a day after the U.S. Thanksgiving holiday, also weighed.

India's gold market is still in the midst of its busy season after the Dhanteras and Diwali festivals earlier this month as many weddings are to take place till December, when demand for the yellow metal tends to go up.

In the quarter to September, India imported 214 tonnes of gold, up 21.6 percent on year, the WGC said.

Following were the prices being quoted by HDFC Bank in rupees in the spot market at 1:15 p.m. INBULL03:

Friday Thursday

================================================

Gold .999/10 grams 20,550 20,553

Silver .999/kg 42,980 40,118

Following were prices in rupees on the Multi Commodity Exchange of India Ltd. at 2:00 p.m. <0#MAU:>:

Contract Current price Net change

======================================================

Dec gold 20,406 +41

Dec silver 41,656 -136

source

Commodity currencies vulnerable to a sell-off

Diposting oleh jim | 18.09 | Commodity, market, News | 0 komentar »Commodity-linked currencies will be vulnerable to a sell-off as concerns about a slowdown in emerging Asia encourage investors to pare their exposure to risk and cut over-extended long positions before year-end.

The growth-linked Australian, Canadian and New Zealand dollars, which earlier this month began to fall from recent highs, are particularly sensitive to concerns China may slow as a result of policy measures aimed at curbing inflation.

Risk aversion is also negative for the three currencies, although the main trigger for their latest move downwards was a jump in Chinese inflation, which fueled speculation of further tightening, rather than the knock to sentiment from euro zone debt problems.

But barring a shock from China, yield-hungry investors may return in the new year to buy commodity currencies, including against the euro, because of the dollar bloc's robust economic fundamentals and higher interest rates.

The Australian dollar may struggle the most in the remainder of the year, having surged 16 percent over a 10-week period to hit a 28-year high of $1.0183 on November 5 before starting to drop back.

"It is noticeable with the Australian dollar over the last few weeks that rallies have been keenly sold into," said Michael Derks, currency strategist at FXPro. "This gives a sense that those who are already long are looking for good levels to sell."

Analysts say the Aussie has the potential to fall as low as $0.95 as investors book profits ahead of the year end, though it could rebound above parity in the new year.

The Aussie has been the most sought-after of the three this year as carry trades -- borrowing in low-yielding currencies to buy high-yielding assets -- made a comeback with U.S. interest rates near zero and the Federal Reserve opting for more easing.

Australian interest rates at 4.75 percent give a sizeable yield advantage for holding Aussie dollars over other major currencies. The market is pricing at least one 25 basis point rate rise over the next year.

But the Aussie is the most sensitive to monetary tightening in China, which could dampen growth and demand for commodities. Australia's close trading links with China mean investors often see the Aussie as a proxy for Chinese and Asian growth.

"Tightening in China is the critical story for commodity currencies," said Simon Derrick, currency strategist at Bank of New York Mellon. "China is infinitely more worried about inflation than about slowing growth."

China raised banks' reserve requirements on November 19 for the second time in as many weeks. It hiked interest rates on October 19, with more expected.

The Canadian dollar may fare less badly, however.

Analysts at Deutsche Bank see downside risks to the Aussie against the Canadian dollar, on the grounds it would be best placed to benefit from an upturn in the U.S. economy.

"We now see the prospects of a correction lower in Aussie/Canadian dollar as stronger than the prospects of further gains."

The Canadian dollar is less vulnerable than the Aussie and kiwi in risk averse markets, and it rose much less versus the U.S. dollar between August and early November.

Some analysts are less enthusiastic about the CAD, saying the Bank of Canada may be slow to raise interest rates, which are at only 1 percent, although strong inflation data this week may mean rate rise sooner than expected.

"CAD will not burst through parity (against the U.S. dollar) until we get the BOC raising rates," said Kit Juckes, currency strategist at Societe Generale.

POSITIONING

Investors have cut long positions in commodity currencies, especially the Aussie, in recent weeks but analysts see more adjustment to come.

"There's quite a lot of heavy positioning that's to be unwound and we could see a slight acceleration of that, and Aussie and kiwi are likely to feel that more than the Canadian dollar," said Christian Lawrence, currency strategist at RBC.

One-month Aussie risk reversals have shown an increased bias to buy Aussie put options over calls in recent weeks, indicating concerns the spot price will fall further.

Nicole Elliott, technical analyst at Mizuho, said the Aussie could fall to its late October low at $0.9650. Below that level, it risked targeting $0.9380 -- the 38.2 percent retracement of its May to November rally -- especially with liquidity thin.

"In 2008, the hardest hit was the Aussie, precisely because it had been the darling and the carry trade one, and it still has that problem," she said.

Elliott still believes the currency should strengthen in the medium term, however -- a view shared by most analysts.

"The Aussie is still one of the few currencies people are happy to hold," said Niels Christensen, strategist at Nordea in Copenhagen.

source

China may be willing to soften the impact of its cut in rare earth export quotas

Diposting oleh jim | 15.57 | News | 0 komentar »China may be willing to soften the impact of its cuts in exports of rare earth elements on firms around the world that depend on them to make high-tech and defense products, EU-based diplomats said on Thursday.

China controls more than 95 percent of global rare earth supplies, giving it a stranglehold over a scarce resource used in a range of products from mobile phones to hybrid batteries.

It has decided to cut its exports on environmental grounds, alarming global industry and prompting discussions among G20 leaders about the potential impact, but a Chinese diplomat indicated China could be open to discussions on the issue.

"We are open to an amicable solution," the Brussels-based diplomat told Reuters, speaking on condition of anonymity.

"We are happy to continue a sustainable supply."

A European diplomat also said there were early indications China was willing to soften its approach on rare earth export quotas.

The European Union has called on China to keep exporting the vital commodity until new mines can produce alternative supplies.

The EU's top trade official, Karel De Gucht, has said the EU will push for a gradual slowing of Chinese exports during meetings in Beijing in December.

STANDOFF OVER SUBSIDIES

But China has indicated it will not ignore European Union moves to penalize China's state subsidies and cheap loans to manufacturers.

EU trade policy plans unveiled in October threatened harsh action against illegal Chinese trade practices, and scrutiny of

subsidies which EU firms say give their Chinese rivals an illegal competitive advantage.

"We should be very careful and try and avoid large-scale trade frictions," the Chinese diplomat said. "Subsidies are a very contentious issue."

Concern is rising in mature economies like the European Union and the United States that China's competitive edge will push traditional sectors out of business, worsening unemployment.

The EU trade deficit with China reached 133 billion euros ($177 billion) in 2009, according to EU figures. But EU exports to China grew 4 percent between 2008 and 2009, as China's rising middle class and relative resilience in face of the financial crisis provided a booming market.

According to Chinese statistics, two thirds of China's 2009 exports were generated by China-based foreign companies -- reason enough to quell European fears that China represents a threat, the Chinese diplomat said.

"China is the general place for foreign business to make profits. It has become a safe harbor for them."

source

Gold falls as strong dollar, profit-booking weighs

Diposting oleh jim | 13.45 | Gold, market, News | 0 komentar »Gold traded just above intraday lows on Friday morning, pressured by a stumbling euro as risk sentiment swung lower and investors decided to book profits amid end-of-week activity and the US Thanksgiving holiday.

But simmering macroeconomic and geopolitical fears - although not as prevalent as they were earlier in the week, when the Irish bailout and military tensions on the Korean peninsula grabbed the headlines - have limited losses.

Spot gold was last at $1,366.90/1,367.70 per ounce, down $5.20 from the previous session and just off a session low of $1,365 - it remains within the broad $1,365-$1,380 range of recent sessions, as investors await news of economic developments in the eurozone and diplomatic tensions in Southeast Asia.

On the charts, next resistance stands at the uptrend line of $1,373 and $1,377 and then further out to the all-time peak of $1,424.60 hit earlier this month. Support is pegged at $1,362 and $1,356.

Precious metals could be prone to price swings today as fund activity kicks in, analysts said, although store-of-value purchasing should keep prices well supported.

"Extended Thanksgiving holidays will probably keep trade thin and the complex remains vulnerable to further pressure as traders look to lock in profits and maintain cash positions to cover margin requirements," analyst James Moore of FastMarkets said.

"But we expect gold and, to a lesser extent, silver to remain underpinned by investment bargain hunting as investors look to diversify against the volatile macroeconomic and geopolitical background," he added.

Markets remain concerned over the threat of sovereign debt contagion in Europe - the cost of insuring against Irish Portuguese, Spanish and Greek debt rose again in the previous session.

Ireland released details earlier this week of a proposed 85-billion-euro EU/IMF package as well as a 15-billion-euro spending cut programme.

Fears linger over a potential ratcheting up of Korean hostilities, although there has been no further military action since shell attacks by both sides on Tuesday. But North Korea said overnight that imminent military drills by the US and South Korea are pushing the two countries to "the brink of war”. This has provided gold with additional support on the dips.

Data this morning did little to assuage investor fears over the health of European economies - German import prices were down 0.2 percent in October when growth of 0.2 percent was forecast. Import prices had risen 0.3 percent in the previous month.

And French consumer spending fell 0.7 percent in October - a 0.2-percent advance had been expected following the 1.6-percent rise in September.

Overnight, Japanese CPI data showed yet another fall in October, down 0.6 percent and in line with expectations. This renewed deflationary fears but was an improvement from the 1.1-percent decline of the previous month.

In a light day for data due to the Thanksgiving holidays, only German preliminary CPI data for November is expected later.

The euro fell to its lowest since September 21 this morning at 1.3215 as risk appetite once again took a tumble. But it steadied later and was last at 1.3238, still around a cent lower from the previous session.

And European equity markets also declined on domestic economic fears after falls in Asia overnight, ranging between 1.3 percent and 1.8 percent lower.

Elsewhere, silver shed 34 cents to $27.17/27.22 per ounce. The platinum group metals (PGMs) suffered as wider risk appetite dissipated - platinum was last indicated at $1,642/1,648 per ounce, a $17 decline, while palladium shed $24 or 3.4 percent to $676/682.

"Given the light data calendar today, the more cyclical platinum and palladium markets are likely to take cues from broader market sentiment," broker Credit Suisse said.

source

Copper: The importance of the supply forecast

Diposting oleh jim | 11.40 | Copper, market, News | 0 komentar »Current consensus wisdom is that copper prices are likely to perform strongly in 2011 as the market faces structural undersupply issues and continuing demand growth mainly from China.

As the VM group writes in its November Metals Monthly publication for ABN AMRO, "Assuming demand from emerging economies continues to grow, and that of the developed world recovers at present rates, then supply-side fundamentals will ultimately determine price performance.

It adds, "For copper, supply is beset with problems, ranging from declining ore grades at many of the world's major copper mines to the slowing discovery of new replacement mines."

However, it is the assumption about emerging economies that has some commentators a little concerned.

In a note French bank Natixis writes, "More important, for us, was the ongoing rise in developing country inflation data, with November's release from Brazil taking the yoy rate up toward 5.5% yoy. This escalating concern over inflation in developing countries will likely remain a concern for all commodity markets as we move into 2011, with the hope that inflation can be contained without compromising growth set against the fear that countries may need to restrain growth more significantly to bring prices back under control."

Such fears raised their head earlier this month after China raised its interest rates in a bid to cool inflation in the country.

However, Natixis does note, "After the weakness in September, Chinese steel production rebounded slightly in October, rising from 47.9mn to 50.3mn tonnes. This does suggest that Chinese energy rationing has begun to move away from the heavy industries it was initially intended to target, hence the rise in demand for diesel from those smaller energy users that may find themselves subject to electricity shortages.

And ,adds, "The Middle East will remain an important source of demand for raw materials in 2011. Helped by supportive oil prices, many countries are continuing to invest heavily in infrastructure. This week, Trade Arabia reported that construction contracts worth $86bn would be awarded in Saudi Arabia in 2011. In Iraq, four new oil refineries are planned, as international oil companies help to rebuild the country's oil infrastructure."

But, while this all may be the case, it is important to note that Chinese apparent consumption of copper dropped significantly in October, falling from more than 700,000 tonnes in previous months to less than 600,000 tonnes, Natixis says. With Chinese stockpiles of copper high, imports of both unwrought copper and copper products fell sharply, falling by 72,400 and 22,500 tonnes month-on-month respectively.

According to Natixis, "With SHFE stocks continuing to rise, and the SHFE/LME import arbitrage still offside, it is unlikely that conditions in November will have improved. "

Speaking to Mineweb.com's Metals Weekly Podcast two weeks ago, Simon Hunt of Simon Hunt Strategic Services said that in his opinion, there will not be a supply squeeze in the copper market.

He explains that one needs to be careful of how one defines demand. Since 2005 he says, the financial sector has got highly involved in the copper market and, while this demand is real, it differs very much from the industrial demand side of things.

"You have major cable makers saying to the industry that between 2006 and the end of 2010 one million tonnes of copper will be lost to aluminium and fibre optics. How does that square with the tight market? Also across many products, manufacturers through improved design and tighter specifications arte allowing something like 20% to 40% to be used per product. Air conditioning and refrigeration tubes are a fine example, but there are many across the board.

"The second development, which manufacturers have been pursuing with increasing intensity, has been to find new technologies that actually replace copper and the one that is the most prominent is high temperature super conductors, which are either in 2011 or 2012 will start to be put into commercial use."

He adds, "If we're talking real fundamentals there has not been and there won't be any real tightness in the market. Tightness is created by the financial sector, believing that copper is going to be a safer asset than holding dollar assets."

To some extent this view is supported by comments from the VM Group, which writes, "The three copper ETFs now planned (ETF Securities, JP Morgan and Blackrock) can only deepen the deficit, even assuming they receive a lukewarm reception. For a physical copper consumer, the medium-term outlook of a copper market deficit, competing ETF demand, and record high prices can only result in one thing - substitution. Although there is little available to replace copper's superior conducting properties in electrical applications, its uses in piping will certainly be under threat.

"When copper last rallied to record highs in 2007 and 2008, there was a marked and, in some cases, permanent shift to plastic tubing. Should the copper price break and sustain new ground in 2011 and 2012 then we expect a further shift to alternate materials."

The question then becomes, what happens if the continued growth in demand from emerging economies, be it as a result of stubborn inflation or substitution, doesn't emerge?

source

Rio Tinto to spend capital expenditure almost tripled

Diposting oleh jim | 09.36 | Company, iron, News | 0 komentar »Global miner Rio Tinto (RIO.L) (RIO.AX) is to nearly triple its capital spending to $11 billion next year from about $4 billion in 2010, it said on Friday, as it seeks to boost iron ore output by more than 50 percent over five years.

A major focus for Rio is expanding its iron ore division, the group's most profitable, to help meet China's heavy appetite for the raw material to make steel amid buoyant prices. "We believe the first and best use of our strong cashflows and robust balance sheet is to invest in the excellent range of value-adding growth projects across Rio Tinto's product portfolio," Chief Executive Tom Albanese said in a statement ahead of giving a presentation to investors.

Rio, the world's second-biggest iron ore producer, posted a record first-half profit in August and about 70 percent came from iron ore sales.

On Oct. 18 Rio and BHP Billiton (BLT.L) (BHP.AX) scrapped plans to form the world's biggest iron ore joint venture after regulators opposed the plan.

Rio warned on Friday that weak copper output would continue into next year before recovering in 2012.

Copper output would fall 18 percent to 661,000 tonnes this year. "The effect of lower grades will continue in 2011 but rebound in 2012," it said.

In the third quarter Rio produced a record amount of iron ore, but copper output fell 19 percent.

source

European Morning View - Metals sag on broad risk reduction

Diposting oleh jim | 07.25 | market, Metals, News | 0 komentar »Thin holiday trade confined the precious metals to a day of range trade Thursday with gold posting a $7 range and silver 25-cents. The sentiment was echoed across the broader financial markets although risk sentiment appeared positive following the gains Wednesday; the STOXX 50 Index gained 0.25% and FTSE 100 0.75% following a surge in CBI Realized Sales. Despite ongoing Eurozone jitters, as Belgium joined the debt-watch list, the single currency closed only fractionally lower against the dollar and unchanged versus the yen.

Eurozone debt concerns have led risk appetite lower overnight with the euro sliding to a fresh two-month low of 1.3252 against the greenback; EUR/JPY is currently down 0.3% while the dollar has seen broad gains against its major counterparts with the DXY up 0.3%. Equities has also been under pressure overnight amid ongoing EU, Korea and China tightening concerns; the MSCI Asia Pacific Index is off 1.4% and Nikkei 0.4% after Core CPI for Tokyo declined more than expected.

Economic data today includes German CPI, French Consumer Spending and EU Money Supply; none is scheduled from the US.

Bullion prices have been under pressure overnight has a result of the decline in risk sentiment; however, the more industrial metals have posted larger declines with palladium currently down 2.5%, silver 1.3% and platinum 1% compared with gold's 0.4%. Extended Thanksgiving holidays will likely keep trade thin and the complex remains vulnerable to further pressure as traders look to lock in profits and maintain cash positions to cover margin requirements, but we expect gold, and to a lesser extent silver, to remain underpinned by investment bargain hunting as investors look to diversify against the volatile macro-economic and geo-political background.

source

European Opening View - Metals slide as China raises margins and as the dollar strengthens

Diposting oleh jim | 05.30 | market, Metals, News | 0 komentar »The metals opened on a weak note yesterday but went on to climb albeit in quiet trading conditions.

By the close, the metals were up an average of 1.4 percent, having started the European session down around 0.6 percent. This move happened despite a generally firm dollar.

But the metals are under pressure this morning in Shanghai after the Shanghai Futures Exchange said it will raise margin requirements across the metals and increase daily price limits to six percent.

This, combined with the stronger dollar, has weighed on LME prices, which are down an average of 1.5 percent, led by zinc’s 2.7-percent move to $2,120 - lead is down 1.7 percent to $2,286 and copper is down 1.5 percent to $8,210.

7:10 AM +/- +/- % Lots

Cu 8210 -129.75 -1.6% 3674

Al 2266 -23 -1.0% 633

Ni 22424 -226 -1.0% 169

Zn 2120.25 -59.75 -2.7% 4396

Pb 2286 -39 -1.7% 675

Sn 24100 -275 -1.1% 9

Steel Med 518 0 0.0% 0

Volume has also been heavy for copper and zinc at 3,674 and 4,396 lots respectively, so again we are tending to see larger volumes into price declines (see table on right for more details).

In Shanghai the March contracts are down an average of one percent, with copper down 1.3 percent at 61,670 yuan, zinc down 1.1 percent at 17,430 yuan and aluminium down 0.5 percent at 16,340 yuan. Spot Changjiang copper is one percent weaker at 61,500-61,750 yuan, which puts prices either side of the futures.

The LME/ Shanghai arb on copper is getting further from opening, with imported copper priced at a $375 per tonne premium, which suggests China continues to destock.

The dollar is stronger, with the dollar index at 80.05 - above the highs of recent days. The euro is at 1.3290, the pound is at 1.5710 and the Australian dollar is weaker at 0.9695 as is the yen at 83.90.

Gold is also weaker at $1,367 per ounce, which would suggest that geopolitical concerns have eased for a while and the stronger dollar is weighing on bullion prices. Oil is also weaker at $83.50 per barrel.

In equities, Europe was generally positive yesterday, with the FTSE showing a 0.75 percent gain (the US was closed for Thanksgiving), while Asia is weaker, with the Nikkei down 0.4 percent, the Hang Seng and China’s CSI 300 both down around 0.9 percent and the MSCI Asia Apex down 1.4 percent. So European equities are likely to start on the back foot.

Time Country ACTUAL Expected Previous

Germany German Import Prices m/m -0.2% 0.2% 0.3%

All Day Germany German Prelim CPI m/m 0.0% 0.1%

7:45am France French Consumer Spending m/m 0.2% 1.5%

9:00am EU M3 Money Supply y/y 1.3% 1.0%

9:00am EU Private Loans y/y 1.4% 1.2%

Data out today concentrates on the EU, with German CPI and EU money supply (see table on right for more details) - trading in the US is likely to remain thin following yesterday’s Thanksgiving holiday.

On balance, weaker equities, a stronger dollar and continuing concerns over EU debt, plus generally weak chart pictures, suggest the metals may retest underlying support levels again.

source

Precious metals sideways as US festivities kick off

Diposting oleh jim | 23.55 | market, Metals, News | 0 komentar »Precious metals continued to trade within narrow bands during Thursday afternoon business, as the US Thanksgiving holiday kept prices subdued, with safe-haven buying maintaining support.

- Spot gold was last at $1,374/1,374.80 per ounce, flat from Wednesday and just off a session peak of $1,375.10 hit recently. From a technical perspective, resistance now stands around $1,381-1,382, $1,387 and $1,400, with support pegged at $1,364, 1,361 and $1,356.

- Closure of US markets for the Thanksgiving holiday has constrained price movements, while it has also given traders time to digest macroeconomic and geopolitical concerns – events in Ireland and Korea are still keeping markets on tenterhooks.

- The euro – which came within a whisker of posting a new two-month low this morning at 1.3285 – recovered some ground and was last at 1.3342, down marginally on the day. European equity markets were mixed – the FTSE100 and DAX were up 0.1 and 0.2 percent, while the CAC40 fell 0.2 percent – moving tentatively as investors adopted a wait-and-see approach on contagion fears. Bond premiums for Spain, Portugal and Ireland increased again this morning.

- The other precious metals, like gold, continued in a sideways pattern - silver, at $27.50/27.55 per ounce, was last three cents lower. Platinum shed $7 to $1,654/1,660 per ounce while palladium was last indicated at $695/700, down $3.

source

Comex gold sags on pre-Thanksgiving profit taking, record low US core inflation

Diposting oleh jim | 22.40 | Gold, market, News | 0 komentar »Gold on the Comex division of the New York Mercantile Exchange moved down Wednesday after the Commerce Department announced that US core inflation barely increased in October.

Gold futures for December delivery were recently off $5.40 at $1,372.20 an ounce with trade in a restrained range of $1,369 to $1,381.

Year-over-year core inflation rose an all-time record low of 0.9 percent in October, down from a 1.2 percent gain in September.

"Down the road inflation is going to be an issue, as the Fed will pump nearly $2 trillion of quantitative easing into the system via QE1 and QE2; however, these efforts have not yet achieved their goal as core inflation is less than 1 percent. That means that gold's attractiveness as an inflation hedge is minimal," a US-based precious metals trader said.

Earlier this month, the Federal Reserve announced that would buy $600 billion in additional Treasury bonds to combat high unemployment rates and boost inflation.

The trader added that there's still quite a bit of uncertainty in the market as it relates to the US economy and the sovereign-debt crisis in Europe.

"That's why we saw some profit taking as traders in America would rather get out of town to enjoy some turkey without worrying about being washed out on Friday," he said.

Sterling Smith, an analyst with Country Heading, said that gold also consolidated as there's the appearance that the situation on the Korean peninsula has deescalated.

On Monday, North Korea bombed the South Korean island of Yeonpyeong, killing at least two soldiers. The North Koreans attacked after warning the South to halt military drills in the area.

Generally, when there's a major geopolitical crisis gold benefits as it's seen as a safe-haven asset.

Smith added that gold has a past history of large moves, both up and down, the day after Thanksgiving.

"That's something that traders need to be aware of. As for today, most trading desks are winding down, especially in New York, where getting out of the city can be a nightmare," he said.

In other US macroeconomic news, the pace of layoffs slowed to the lowest level since July 2008 with initial jobless claims dropping by 34,000 to a seasonally adjusted 407,000 in the week ending Nov. 20, the Labor Department reported.

But new home sales rose just 283,000 last month, below an anticipated 311,000 and from 307,000 in September. That is the all-time low point since data collection began in 1963.

"The jobless claim number was the best we've seen in quite a while; however, the housing starts number is just terrible," Smith said.

Additionally, durable goods orders fell 3.3 percent in October on the previous month when growth of 0.2 percent had been forecast - orders had risen five percent in September.

The University of Michigan consumer sentiment index for November increased to 71.6, the highest since June, from 67.7 a month earlier. Expectations had been for an increase to 69.5.

source

Gem Diamonds sells two stones worth a total $ 22.7m

Diposting oleh jim | 20.37 | Diamonds, market, News | 0 komentar »Gem Diamonds Ltd has sold two major gems found at its Letseng mine in Lesotho for a total of $22.7 million.

The London-listed company said on Thursday it sold the 196-carat and 184-carat rough white diamonds by tender in Antwerp to the South African Diamond Corporation (SAFDICO)

"It is very pleasing that Letseng's diamonds continue to attract strong prices," chief executive Clifford Elphick said.

Also, at the normal tender for Letseng's output, a 4.68-carat rough blue diamond was sold for $155,000 per carat, the highest price per carat achieved for a Letseng rough diamond, the company said.

source

Precious metals step back after bullish US jobs data

Diposting oleh jim | 18.35 | market, Metals, News | 0 komentar »Gold stepped back from session highs early on Wednesday afternoon after positive US jobs figures gave risk appetite a shot in the arm while eurozone woes and geopolitical concerns continue.

Spot gold - which peaked at $1,381.60 this morning, just a shade off yesterday's week-and-a-half high - was last at $1,376.60/1,377.40, still $4.60 higher on the day. On the charts, having taken out resistance at $1,371 and $1,377, gold's next upside target stands at the all-time high of $1,424.60. Support is pegged at $1,356 and $1,333.

In the US, the latest weekly unemployment data surprised to the upside - 407,000 new applications were made last week, below the anticipated 434,000 and the previous week’s reading of 441,000. But durable goods orders fell 3.3 percent in October on the previous month when growth of 0.2 percent had been forecast - orders had risen five percent in September. New home numbers, HPI and University of Michigan consumer sentiment and inflation expectation figures are due later.

In the eurozone, Ireland is due to release its austerity budget later this afternoon after Prime Minster Cowen earlier confirmed that the Irish state was in discussion with the EU and IMF over an 85-billion-euro bailout. The euro - which fell to its cheapest since September 22 at 1.3284 this morning - erased losses after the data and was last at 1.3392, marginally up on the day. European equities remained up as risk aversion moderated further - the FTSE100, DAX and CAC40 were last 0.8 percent, 1.3 percent and 0.4 percent higher - while US futures were also set to open higher on Wall Street.

Precious metals followed in gold’s footsteps - silver was last at $27.39/27.44 per ounce, one cent lower and off an intraday high of $27.72. Platinum and palladium, at $1,662/1,668 and $690/695 per ounce, were $8 and $3 higher.

source

Gold slips as U.S. data calm economic fears

Diposting oleh jim | 16.31 | Gold, market, News, Political Economy | 0 komentar »Gold edged down in thin trade on Thursday after encouraging U.S. jobless claims data calmed some worries about economic growth, but concerns over tensions on the Korean peninsula could offer some support.

Bullion barely reacted to news that Vietnam's central bank had granted additional quotas for domestic companies to import gold between now and the year end, but dealers noted buying on dips from consumers in Hong Kong and Southeast Asia.

Spot gold eased $1.56 to $1,372.15 an ounce by 0640 GMT - well below a lifetime high around $1,424 struck in early November. It had hit an intraday low around $1,367 an ounce.

U.S. gold futures fell $1.2 to $1,371.8 an ounce.

U.S. markets are shut on Thursday for the Thanksgiving holiday. "I would say sentiment is still bullish. The conflict between North and South Korea is not going be solved within a short period of time," said Ronald Leung, director of Lee Cheong Gold Dealers in Hong Kong.

"It will take a bit of time. There may be more buying at below $1,370."

South Korea said on Thursday it would increase troops on islands near North Korea with Pyongyang, warning it would follow its bombardment earlier in the week with more attacks if its wealthy neighbour tried any "provocations".

The United States says it believes North Korea's actions were an isolated act tied to leadership changes in Pyongyang, and many experts say the North carried out the shelling to burnish the image of the inexperienced and little-known younger Kim.

In the currency market, the euro struggled near a two-month low as the euro zone debt crisis showed signs of spilling over from Ireland to other euro zone members even after Ireland unveiled an ambitious austerity plan.

But in the United States, initial jobless benefits claims fell to their lowest level in more than two years last week while consumer spending rose for a fourth straight month in October, fueling hopes the economic recovery is strengthening.

"I would say there's a mixed bag of trading today. We see sales of scrap but at the same time, there's also physical buying. Honestly, consumers don't want to get short. Each time, they will just buy on dips," said a dealer in Singapore.

"But the U.S. holiday deters people from doing much.

There's some light buying from Indonesia and we did see buying from India yesterday," said the dealer.

The gold market in India, top consumer of the metal, is still in the midst of its busy season after the Dhanteras and Diwali festivals earlier this month as many weddings are to take place till December, spurring at least some demand for the metal that plays an important role in social functions.

Tokyo gold futures

"The Japanese don't seem to show interest in buying gold as a safe haven, although our neighbours are involved in a serious conflict," said a physical dealer in Tokyo. "Maybe the Japanese are optimistic it could be resolved."

Oil edged lower on Thursday, after rising more than 3 percent a day earlier on strong U.S. macro-economic data, as concerns about European debt lingered.

source

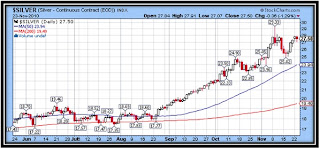

Silver prices supported investment demand

Diposting oleh jim | 14.27 | market, News, Silver | 0 komentar »Since, Bart Chilton, the Commissioner at the CFTC, acknowledged that there has been price manipulation in the silver market, the price of silver has held relatively firm above the $25 an ounce level. However, I believe that the current price action, has little to do to with the commissioner's statement, and is merely reacting to current market conditions. And, as far as I am concerned, the main driving force for the rising prices of silver is due to increased investor demand.

Global investment, including coins, is set to rise to record levels this year, with the net value reaching roughly $4 billion. According to the US Mint, sales of US silver Eagles in November are already a whopping 3,775,000 ounces, bringing the total of silver eagles sold this year to 32,405,500 silver eagles. The total number of silver eagles sold last year was 28,766,500. The Royal Canadian Mint recently said that silver-coin sales will jump more than 50 percent this year. The Perth Mint may match that gain, according to Ron Currie the sales and marketing director. "There seems to be more upside with silver than gold right now," said Currie. According to the Perth Mint Silver-coin sales will climb as investors seek to protect their wealth from weakening currencies.

Even though it is sometimes referred to as "the poor man's gold," I believe that, over the next few years, silver will make more money than gold for people prudent enough to own some.

Of all the silver mined over the past 5,000 years, more than 90% of it has been used up. It's gone forever. For many years, the U.S. government maintained a stockpile of silver. It held hundreds of millions of ounces in its inventory as one time silver was used to back up the US currency. Now they don't have one ounce and the number of silver eagles minted this year is approaching the level of all the silver produced in the USA. And, unlike gold, silver has a myriad of industrial applications.

Simple demand/supply dynamics of this market suggest that the price of silver should go much higher. Recently, world renowned silver expert, David Morgan in an interview with James Turk said. "We are so tight in the silver supply right now, almost every commercial bar that exists is held for one reason and for one reason only and that is investment purposes, not commercial use." According to Morgan any new demand for silver for commercial use, could really force prices higher due to the shortage of silver. "So any commercial use that comes on top of the investment purposes that already exist, is going to force the price not only higher, but it is going to force it higher now, because it is required for industry."

Recently, we have seen the gold/silver ratio drop from 68:1 in August this year to 52:1 by the beginning of November. As you know I have often referred to this ratio and while it is not a set formula we have seen it drop to more reasonable levels. However, I believe that we will soon see this ratio trade at 45:1. James Turk whose long-term view is that by 2013 to 2015 gold is going to be$ 8,000 an ounce and that the ratio is going to fall and go below 20. This would put the price of silver at $400 an ounce!

Personally, at this time, I have a more conservative outlook towards the silver price, but based on historic ratios, silver could easily triple from here and still be undervalued compared to gold. And, if silver simply matched its previous highs in inflation-adjusted dollars, it would be over $130 an ounce now.

I have long advocated accumulating physical gold and physical silver, because that's where you really want to be. You have exposure to the price and you also have money that hasn't got any counterparty risk, so you're not reliant on some promise of a bank, a central bank or something of that nature. But, do not be beguiled into believing that limited edition medallions offer better investment potential than bullion.

TECHNICAL ANALYSIS

I believe that the price of silver is consolidating between $25/oz and $29/oz., and that the upward momentum will continue.

About the author

David Levenstein began trading silver through the LME in 1980, over the years he has dealt with gold, silver, platinum and palladium. He has traded and invested in bullion, bullion coins, mining shares, exchange traded funds, as well as futures for his personal account as well as for clients. www.lakeshoretrading.co.za

Information contained herein has been obtained from sources believed to be reliable, but there is no guarantee as to completeness or accuracy. Any opinions expressed herein are statements of our judgment as of this date and are subject to change without notice.

Gold: Platinum ratio predicts repeat the 70's gold rally

Diposting oleh jim | 12.17 | Gold, News, Platinum | 0 komentar »Most people are mainly concerned with what is going on right now and are less concerned with what happened yesterday, last week or last year. The further in the past an event or development, the less are we concerned about (or aware of) it, and the less is our understanding of it. This appears to be our nature, and it causes many to miss important "big picture" developments.

Here, I would like to discuss one such development and at the same time highlight the outlook for economic conditions over the next few years.

Platinum has been a star performer since the beginning of this century. From about the year 2000 to 2008 it went from just under $400 to a high of $2200. That is an incredible rally, and possibly unrivaled during that period by any other metal or investment class. What is discussed here for platinum holds true for many other assets, even fiat money, but in different aspects, and to various degrees.

Since about the turn of the century, platinum has become the prestige metal. Even credit card companies got into the act by replacing gold cards with platinum cards as their premier credit cards. This, together with platinum's subsequent rise, ensured that the world became a little platinum crazy.

A lot of this fascination with platinum was due to it again becoming more valuable than gold. This platinum mania was indeed justified due to its stellar price performance, especially versus gold. However, it is this very fascination and mania that prevents many from seeing what has been developing over the last 40 years or more, and is now about to conclude (over the remainder of gold's bull market). Many will be surprised at the impressive gold miner rallies, straight ahead, which will come despite weak general markets.

To understand this development, it is important to understand what the outlook is for the world economy over the next decade.

For most of the last century we have had corrupt debt-based monetary system that has been suppressing the price of gold for at least the last 80 years. Fiat money and fractional reserve banking are main features of this system, which is the chief underlying cause of most of our economic problems.

This system is now in its 11th hour, and so are all those trends that have come about due to its existence. One such trend is: platinum consistently getting more valuable than gold. There are many more, such as gold and gold mining shares as a percentage of global assets decreasing significantly plummeting from 26% of global (investment) assets in 1981 to just 0.8% in 2009, according to Sprott Asset Management.

It is important to note that there will always be such trends, such as increase or decrease between gold and other asset classes; however, under a proper monetary system they will not be as out of balance to the extreme that they are under a debt-based monetary system.

Below is a long-term gold/platinum ratio chart.

chart comes from sharelynx.com

During the gold bull market of the 1970s, it is clear that this ratio was in a significant uptrend. It went from about 0.2 to 1.4 over a 12 year period. That is a seven-fold increase. I have said it before, the same conditions that propelled gold and other commodities higher during the 70s are present now.

These factors are pushing gold higher now and will continue to do so for many years to come. I certainly expect the gold/platinum ratio to trend higher, just as it did in the 70s. As you can see on the chart, the trend for this ratio began moving higher in 2008 and, like it did in the 70s, it will accelerate as we move along in this bull market.

The great debt bubble of the last century peaked in 1999, when the Dow/gold ratio peaked. This was the tipping point, which signaled the end of the prosperity that was built by this debt. This was soon confirmed, when gold bottomed, and started an uptrend that continues to accelerate. Likewise, in the middle of the 60s, the Dow/gold ratio peaked, whereafter the link of the dollar to gold was removed and gold started its upward march in the 70s.

We are on a downward economic activity trend, and this should accelerate and continue until debt levels are acceptable for a new economic boom. I believe this will take at least 10 years.

Despite the fact that commodities, like platinum, will outperform most asset classes over the next years, I believe that they will still depreciate significantly as compared to gold (and silver). This is basically what happened during the 70s and is also what happened during the great depression. Below is a chart that shows the cyclical downturn(s) of industrial production in the US over the last 50 years.

You will notice that during the two parts (70 to 75 and then 76 to 80) of the gold bull market, industrial production turned down significantly. Also, note that the downturn occured towards the end of those gold rallies and, in the case of the second one, continued until after the end of the gold rally.

Back to the long-term gold/platinum ratio chart

On the chart, you will see a 25-year down-trend resistance line, which was broken in 2008. In textbook fashion, the ratio has moved up quickly since then, whereafter it has returned to test the breakout area. A quick move to 1 is expected very soon, and it would go a long way in confirming that the trend in this ratio is unfolding very much like the one of the 70s and is likely to continue throughout this decade.

I believe that the ratio will reach the 1.4 level faster than many would believe (if they believe at all) and that it will go on to reach levels unimaginable for many, because they are unable to comprehend the long-term developments. I just wonder whether banks will revert back to gold credit cards as their premier card. Actually, I wonder if banks will still be around.

Herbert Moolman is a gold and silver analyst and is the founder HG and associates

source

Another mining right dispute has emerged in South Africa, with Palabora Mining appealing against the granting of a new mining right to a third party over an area that the copper and magnetite giant is already mining.

In a statement issued here, Palabora said the government had granted an unnamed third party the right to mine copper, magnetite, phosphate apatite and baddeleyite in an area for which Palabora held an old order mining right to mine all base metals except phosphates.

The statement added that the company had submitted its old mining right for conversion into a new right as laid out in the law, which required companies to convert them by a set date or lose them altogether.

“Current mining operations are not affected by this matter,” Palabora said

.

Earlier this year, Lonmin and Kumba Iron Ore, a unit of Anglo American, said the government had deprived them of mining rights when it awarded prospecting licences ‒ some to people linked to high-ranking officials ‒ over areas where the two mining giants operated.

Analysts said South Africa's handling of disputed mineral right awards had damaged the resource-rich country's reputation and had raised investor concerns over transparency and governance in the key economic sector.

South Africa's mining ministry revealed earlier this month that the sector was rife with problems, including illegal drilling, rights sold on without permission, and companies having competing claims to the same plot.

The ministry has imposed a six-month halt on new prospecting bids from the start of September in order to overhaul mining laws, iron out irregularities in the way rights are awarded, and audit existing exploration and drilling contracts.

source

9-month revenue soared 74% in metal prices rebound - Antofagasta

Diposting oleh jim | 08.11 | Company, Copper, News | 0 komentar »Chilean copper producer Antofagasta said nine-month core earnings surged 74 percent due to a rebound in metals prices and higher output as it launched the plant at its new Esperanza mine.

The London-listed group said on Thursday earnings before interest, tax, depreciation and amortisation (EBITDA) increased to $1.96 billion on revenues of $3.17 billion that were up 57 percent.

The company has commissioned the plant at its new Esperanza mine and the first copper concentrate shipment was due by the end of the year, a statement said.

On Nov. 3, the firm posted higher-than-expected third quarter costs, overshadowing an expected rise in copper output.

source

outh African power utility Eskom Holdings Limited says the country needs to ensure that it has sufficient, affordable coal supplies for domestic power plants, as exports become more lucrative for producers.

“Competition with exports is raising domestic coal prices, and that has an knock-on effect on electricity tariffs,” said Eskom Coal Purchasing Unit manager Jeanie Moothoo in a speech here. “Domestic coal prices are expected to continue rising,” she said.

“There needs to be a clear policy on coal exports versus domestic requirements,” she added, “and domestic pricing principles need to be clarified.”

Producers can make more money by selling coal on the export market to India and China than to Eskom, deputy mineral resources minister Godfrey Oliphant said last week.

BHP Billiton Limited, Xstrata plc and Anglo American plc are among the largest coal producers in South Africa, which generates about 90% of its power from the fuel.

The government said in 2008 that it might limit exports of coal from the country. Coal shortages contributed to a power crisis that shut down mines, smelters and shopping malls in South Africa during the first quarter of that year.

The government will consider amendments to mineral laws in the next few months to regulate coal supplies, Fin24 reported last week, citing Oliphant.

“Business exists to maximise profits,” Landi Themba, director of coal and gas policy at the Department of Energy, said in a speech in Johannesburg. “But coal is a finite resource. If we don’t manage it well, we could exhaust it sooner than we expect.”

source

European Opening View - Metals get some lift as selling pressure fades

Diposting oleh jim | 16.03 | market, Metals, News | 0 komentar »Yesterday was another down day for the metals and markets as geopolitical issues added to the already present concerns affecting the markets, namely sovereign debt in Europe and the possibility of a slowdown in China. Gold and the dollar were the two to buck the trend highlighting investors shift into safe-havens. At the lows of the day base metal prices were off 2.3 percent, but they closed down by an average of 1.4 percent.

7:13 AM +/- +/- % Lots

Cu 8265 111.5 1.4% 3451

Al 2283 31.25 1.4% 494

Ni 21800 196 0.9% 158

Zn 2137 42.25 2.0% 1821

Pb 2215 36.75 1.7% 189

Sn 23900 25 0.1% 22

Steel Med 510 0 0.0% 0

This morning the buyers have returned and the base metals are up by an average of 1.2 percent, with most of the metals seeing good gains with the exception of tin that is up just 0.1 percent. Copper is up 1.4 percent to $8,265 after lows yesterday of $8,050. Volumes into the rebound have been relatively good for copper and zinc, but are lower than we saw on recent down days. So for the moment prices have avoided testing last week’s lows and are now in consolidation mode.

Time Country ACTUAL Expected Previous

EUR German Ifo Business Climate 107.6 107.6

9:00am EUR Italian Retail Sales m/m 0.3% 0.0%

9:30am GBP Revised GDP q/q 0.8% 0.8%

9:30am GBP Prelim Business Investment q/q 0.6%

9:30am GBP Index of Services 3m/3m 0.5% 0.3%

10:00am EUR Industrial New Orders m/m -2.6%

12:20pm GBP MPC Member Sentance Speaks

1:30pm USD Core Durable Goods Orders m/m 0.7%

1:30pm USD Unemployment Claims 434K 439K

1:30pm USD Core PCE Price Index m/m 0.1% 0.0%

1:30pm USD Durable Goods Orders m/m 0.2%

1:30pm USD Personal Spending m/m 0.5% 0.2%

1:30pm USD Personal Income m/m 0.4% -0.1%

2:00pm EUR Belgium NBB Business Climate -2.7 -2.8

2:55pm USD Revised UoM Consumer Sentiment 69.5 69.3

2:55pm USD Revised UoM Inflation Expectations 0.03

3:00pm USD New Home Sales 311K 307K

3:00pm USD HPI m/m -0.1% 0.4%

3:30pm USD Crude Oil Inventories -1.9M -7.3M

5:00pm USD Natural Gas Storage -6B 3B

6:00pm EUR Buba President Weber Speaks

Tentative USD Treasury Currency Report

11:50pm JPY Trade Balance 0.63T 0.59T

11:50pm JPY CSPI y/y -1.0% -1.1%

In Shanghai the February contracts are up by an average of 0.7 percent, copper leads the advance with a 1 percent gain to Rmb 62,450, zinc is up 0.8 percent at Rmb 17,425, while aluminium is up 0.2 percent at Rmb 16,290. Spot copper in Changjiang is up just 0.2 percent at Rmb 61,850-62,250 so the market is back in contango, while the LME/Shanghai arb puts imported copper at a premium of $310/tonne.

The dollar remains strong with the dollar index at 79.56, yesterday it extended gains to 79.82 as it broke out of a small bull flag. The euro is weak at 1.3392 as are other currencies with the pound at 1.5830, the aussie at 0.9795, although the yen has firmed slightly to 83.15. Gold is at $1,378 and oil is at $81.70. So again the stronger dollar, gold and yen all suggest haven buying.

Equities – the Dow closed down 1.3 percent, the Nikkei is down 0.8 percent, but it had some catching up to do as it was closed yesterday; the Hang Seng is up 0.75 percent, China’s CSI is up 2.3 percent and the MSCI Asia Apex is up 0.3 percent. So it does look as though some bargain hunting is emerging.

On the economic data front today is another busy day with some of the usual Thursday US data coming out today ahead of tomorrow’s Thanksgiving. German Ifo business climate data is out at 9am GMT, , while in the US we have initial jobless claims, durable goods orders, personal income and spending and new home sales, to name a few – see table on right for more details.

Our view is that given the deterioration in the fiscal/economic and geopolitical backgrounds, and considering the rapid gains seen since June, there is room for deeper corrections as profits are taken. However given the buy the dip mentality that seems ingrained in the market, we feel there will be bouts of buying along the way, but we would expect rebounds to be sold into.

source

Comex gold up on safe-haven buying due to Korea, eurozone anxiety

Diposting oleh jim | 13.14 | Gold, market, News | 0 komentar »Gold on the Comex division of the New York Mercantile Exchange rallied on Tuesday as fighting on the Korean peninsula and uneasiness over the European sovereign debt situation prompted investors to avoid riskier assets despite a stronger dollar environment.

Gold futures for December delivery were recently up $20.40 or 1.5 percent at $1,378.20 per ounce.

"Gold is rallying due to the unexpected flare-up near the North and South Korean border," a US-based gold trader said.

“When people woke up in New York this morning they saw those stunning images of black smoke bellowing up from that small island,” he added. “It's the worst bombing since the end of the Korean War so there's a legitimate fear that things could escalate.”

North Korea bombed the South Korean island of Yeonpyeong with artillery shells near a disputed western border, killing at least two soldiers. The North Koreans attacked after warning the South to halt military drills in the area.

Based largely on Asian instability, the Dow Jones Industrial average dropped sharply and was recently trading down 140 points or 1.25 percent at 11,038.

Additionally, the European sovereign credit crisis appears to be migrating from Ireland to the continent, which has investors fleeing the euro.

The spread that Spain and Portugal must pay on 10-year debt compared to Germany moved to a new high early this week. There is now a growing sense that other counties might soon ask for their own bailout package.

"Gold likes a crisis and you have plenty of them to pick from today - $1,400 is back in play until this geopolitical and economic tension dissipates," the trader said.

Based on the worries out of Europe, the dollar jumped 1.5 percent to hit 1.3412 against the euro. The greenback was also boosted by a positive revision in the third-quarter US GDP to a 2.5 percent annual rate from two percent.

Nevertheless, the weaker euro did little to dampen gold's momentum.

"In a vacuum, the Fed's quantitative easing (QE2) programme would have led to a weaker dollar but hasn't happened because there are these other messes around the world," a second New York-based gold trader said.

"The dollar has suddenly become the best of the worst currencies when you factor in the sovereign debt crisis, the political uncertainty in Korea and China's posturing that it wants to slow down growth," he added.

source

1st U.S. Mint proof-quality silver bullion coin offering since ‘08 sends sales soaring

Diposting oleh jim | 11.08 | market, News, Silver | 0 komentar »U.S. Mint customers ordered a total of 273,212 2010 Proof Silver Eagles coins in less than three full days after the coin was initially released on November 19, 2010, after a two-year absence.

A collector's version of the official U.S. Mint American Eagle Silver Bullion Coin, the Proof Silver Eagle has not been issued since 2008 when 700,979 coins were sold.

The 2010 American Eagle One Ounce Silver Proof Coin is being offered at a sale price of $45.95.

In October the U.S. Mint announced it would issue a collector-grade .999 fine silver American Eagle Silver Proof coin. U.S. Mint Director Ed Moy said the Mint "worked very hard with vendors" to triple the number of silver blanks available. This allowed the Mint to continue to produce bullion eagles and still offer a proof version.

The Mint warned customers that they anticipated "usually high demand" for the American Eagle Silver Proof Coin. There is a household limit of 100 coins. Production of the 2009 version of the coin was canceled last year because of high demand for the American Eagle Silver Bullion Coin.

"Legislation mandates that American Eagle Silver Bullion Coin production take precedence over the numismatic version of the coin," the Mint said. ‘Economic conditions drove investor demand for the United States Mint's silver bullion coin to unprecedented highs in both Fiscal Years 2009 and 2010."

The collector proof coin features the West Point "W" mintmark. Bullion coins do not have the mintmark not a brilliant finish. The bullion coins are not sold directly by the Mint.

As of November 22nd, 32,405,500 bullion Silver Eagle Coins have been sold so far this year.

source

Australian markets review

Diposting oleh jim | 08.59 | Commodity, market, News, stock | 0 komentar »STOCKS closed flat today after losses were cut as investors fed on shares weakened by worry over the Korean conflict and European debt.

The benchmark S&P/ASX 200 bounced back from an earlier low of 4551, to be down 4.4 points, or 0.1 per cent, at 4584.7 for the close.

The broader All Ordinaries index lost 3.7 points (0.08 per cent) to 4673.2 points, well off its low of 4638.

On the ASX24, the December share price index futures contract was 10 points lower at 4595, with 36,113 contracts traded.

The market opened lower on negative sentiment from offshore markets, as military conflict between North Korea and South Korea added to risk-averse attitudes.

Most stocks rebounded as local trading continued, with the exception of the big miners.

Said CMC Markets institutional equities dealer David Barrett-Lennard: “It really feels like the market is looking beyond the concerns of the moment, which we have faced before, and viewing today as an opportunity to finally put cash that has been sitting on the sidelines to work.”

The day’s best performer was Telstra, which rose 4 cents (1.46 per cent) to $2.78. The jump came as federal government legislation paving the way for the telco to participate in the NBN won the support of independent senator Nick Xenophon.

BHP Billiton lost 19c to $42.95, Rio Tinto shed $1.04 to $82.49 and Fortescue Metals gained 5c to $6.45.

Newcrest Mining added 26c to $$39.67 as the gold price rose due to uncertainty in global markets.

The spot price of gold in Sydney at 1622 AEDT was $US1375 per ounce, up $US15.64 from yesterday’s close.

Westpac was the best of the banks, adding 9c to $21.40 after opening lower.

The other banks also improved through the day but closed lower, with Commonwealth losing 3c at $48.15, ANZ dropping 6c to $22.28 and National Australia Bank 11c lower at $23.45.

Said IG Markets strategist Ben Potter: “Sentiment is a funny thing and can change like the flick of a switch and this afternoon's trade may in fact be signalling the start of a new upward leg."

source

Gold market during the conflict in the Korean peninsula

Diposting oleh jim | 07.42 | Gold, market, News | 0 komentar »Gold was steady on Wednesday as investors awaited further developments on the conflict in the Korean peninsula amid worries about the euro zone debt crisis.

South Korea warned North Korea of "enormous retaliation" if it took more aggressive steps after Pyongyang fired scores of artillery shells at a South Korean island in one of the heaviest attacks on its neighbour since the Korean War ended in 1953.

"It's mainly safe-haven buying in gold after North Korea and South Korea exchanged fire yesterday, in addition to the buy-on-dip type," said Li Ning, an analyst at Shanghai CIFCO Futures.

"Gold is likely to revisit its record high at the end of this year or next year, thanks to strong demand, particularly from this region.

Spot gold shed $1.5 to $1,374.70 an ounce by 0347 GMT, after rising to $1,382 in the previous session, its highest since Nov 12.

U.S. gold futures fell 0.2 percent to $1,374.7.

In Ireland, the deeply unpopular government said it will explain on Wednesday how it plans to save 15 billion euros over the next four years, inflicting more pain on voters to prove that it can tackle the country's debt.

The euro hovered above two-month lows on Wednesday, while the dollar was steady after rallying near a two-month high of 79.743 in the previous session.

"There is some book-squaring before the U.S. holiday tomorrow. Gold is still on the upside, thanks to risk aversion," said a Hong Kong-based dealer.

Demand from Asian countries remained robust, with bargain hunting seen around the $1,350 level, but scrap selling was scarce, he added.

The U.S. economy grew faster than previously estimated in the third quarter, but a slump in sales of previously owned homes in October indicated the recovery remains too anemic to reduce high unemployment.

The U.S. is scheduled to release a batch of data later in the day, including the weekly initial jobless claims, October durable goods order and new home sales, just ahead of the Thanksgiving holiday on Thursday.

Holdings in the iShares Silver Trust, the world's largest physically-backed exchange-traded fund, rose to record highs for three consecutive sessions, signalling strong investment demand in the metal, seen as an alternate investment from gold.

Holdings in the SPDR Gold Trust remained unchanged at 1,285.084 tonnes.

Spot silver gained 0.3 percent to $27.56 an ounce.

Spot palladium led the precious metals complex by gaining 1.4 percent to $695.72.

source

Japanese latest step in the supply of scarce land supply,

Diposting oleh jim | 06.46 | News, Political Economy | 0 komentar »Japanese trading house Sojitz Corp (2768.T) said it has forged a rare earth procurement deal with Australian miner Lynas Corp (LYC.AX), marking the latest move by Japan to reduce its reliance on China for the crucial minerals.

News of the deal comes one day after Australia promised to be a future long-tem supplier of rare earths to Japan, after shipments from China to Japan had stalled amid a spat over disputed islands in the East China Sea.

Shares of Sojitz surged 9 percent on the news, with volume spiking to more than 8 times the daily average of the past 3 months.

Under the agreement, the two aim to start shipments of 1,000 to 3,000 tonnes of rare earth in the final quarter of 2011, and boost shipments to more than 9,000 tonnes per year by early 2013, Sojitz said.

Sojitz and the state-run Japan Oil, Gas and Metals National Corp (JOGMEC) will together invest up to $250 million to finance a Lynas expansion project, Sojitz said, adding that buying a stake in Lynas in the future was an option.

China has a virtual monopoly on world supplies of rare earths, used in everything from flat screens to defence equipment, and its moves to curb exports have prompted consumer nations to look for alternative supply sources and suppliers to expand business opportunities.

Lynas, which plans to begin production next year, has already signed about half a dozen supply contracts including a new long-term deal with a European consumer announced earlier this month.

While China accounts for about 97 percent of world's total production, rare earths reserves are available in other regions.

China has the largest reserves, accounting for 36.4 percent of total, followed by 19.2 percent in the Commonwealth of Independent States, 13.1 percent in the United States and 5.5 percent in Australia, according to USGS Mineral Commodity Summaries.

Japan's trade minister Akihiro Ohata said on Wednesday that Japan-bound rare earth shipments have left China, confirming the end of a de-facto suspension by Beijing on exports of the minerals since late September.

Japan has been stepping up efforts to diversify its sources of supplies of the strategic minerals, agreeing with Mongolia last week to cooperate on developing mineral resources, including rare earths.

Last month, Tokyo agreed with India to cooperate in developing and recycling rare earth minerals and rare metals, as well as with Vietnam to mine rare earths in the southeast Asian nation.

Demand for rare earths is forecast to grow by between 7 percent and 9 percent a year over the next five years against a 5 percent increase in supply, according to Resource Capital Research analyst Trent Allen.

"This could create severe undersupply of some elements, especially the scarce middle and heavy rare earths," Allen said.

source

Silver shortage, a symptom of manipulation?

Diposting oleh jim | 04.41 | market, News, Silver | 0 komentar »Why there is rationing of silver coins in the bullion market? According to reports, US Mint is rationing silver Eagles sales. The same goes for the Perth Mint in Australia and other mints throughout the world.

Bullion and coin dealers by the droves have, in the past, and are now, again, quoting customers weeks, maybe months, for deliveries of silver bullion, in any quantity. This indicates a shortage of silver in the market. But the truth is different.

Actually, there’s no shortage of physical silver at all. There’s plenty of silver, in fact, as in hundreds of millions of ounces of above-ground stock, with a lot of this stock stored in secured warehouses, bank vaults, home safes and, even, hidden in the ground in backyards across the world.

Availability of silver for sale, however, is another matter all together. You can be assured of procuring as much silver as you want if the offer to buy is raised to $100 per ounce (.999).

But at $26 per ounce, the world has an acute problem at the moment in the silver market. So why aren’t the economic fundamentals of supply/demand equilibrium working in the silver market?

The silver market has endured massive price suppression for decades, while underscored most recently by the continuation of the silver suppression scheme perpetrated by the COMEX, LBMA and the bullion dealers associated with these two entities.

The two dealers under suspicion, but not forthrightly accused of suppressing the silver market, are JP Morgan and HSBC, according to a Commodities Futures Trading commission (CFTC) announcement of October 26.

“I believe that there have been repeated attempts to influence prices in the silver markets,” said CFTC’s Bart Chilton. “There have been fraudulent efforts to persuade and deviously control that price. Based on what I have been told by members of the public, and reviewing in publicly available documents, I believe violations to the Commodity Exchange Act (ACT) have taken place in silver markets and that any such violation of the law in this regard should be prosecuted.”

But two weeks later, the week ending November 12, the cartel was, again, involved in a silver “take-down” scheme, which further strained available supplies. This time, through the COMEX, the banks were able to take down the silver price by raising futures margins requirements for speculators in the silver market, which, in and of itself is normal as prices in the commodity rise.

It’s the timing of the margin requirement change that’s suspect to many skilled observers, however. By not incrementally adding to margin requirements in any market, a slew of highly-margin longs could be herded for slaughter, which must sell en mass to square positions with the clearing house when the margin requirement is finally raised.