Whatever was the real reason for the Fed to initiate another round of quantitative easing, the end result is fairly clear: the Fed is wittingly or unwittingly in the process of creating new bubbles - in equity and commodity markets.

What we had feared would transpire from spring 2011 until around mid-2012 may now be starting to play out. One of our friends eloquently described QE as nothing more than another great government Ponzi scheme with a fancy name that would make the Advertising Industry proud.

Chart 1: St Louis Monetary Base

QE2 is being launched at a time when the US economy is showing more signs of recovery. Both ISM surveys were positive; auto sales rebounded; the MasterCard Spending Pulse was strong; M2 is recovering; and the ADB employment figures came in better than expected to name just a few data points.

The potential for political gridlock looks as if it will be averted, or at least the worst of it, as Obama is now open to compromising with the GOP on the Bush tax cut extensions. Should this become reality it will allow the recovery to be that much better, a development that would be US$ positive.

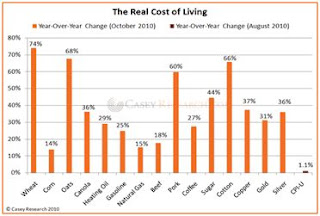

Chart 2: The Real Cost of Living

What is unnerving to our eyes is the likely continued rise in food and energy prices, unless QE2 is reversed. This chart courtesy of Casey's Daily Despatch shows how much the basic ingredients for households have risen so far this year. As we said in a previous note what the Fed gives with one hand it takes away with another, but, this time, to hurt the very households that the Fed is supposed to help.

Under current Ponzi related conditions, we should recognise the futility of economic forecasting. Instead we should focus on the more secure knowledge that bubbles always burst and that following severe financial crises, economic growth is slow until debt is expunged from the system.

Bubbles have rest periods. At some point, markets will have run their course for the time being and this might well be in early 2011, from which declines in equity and commodity markets should be experienced.

This will be followed by that last sharp move up in these markets, which we have been forecasting with copper going to $12,000 or even higher. Such a price won't be driven by real fundamentals as we keep saying, but by financial markets. Speculation will be rampant probably even more than it is today, being part of the bubble environment.

Whether the bursting of the financial asset bubble will be late next year or a year or so later is anyone's guess. It will herald in real deflation and sharply falling asset prices with copper falling below US$1500 by 2016. In short, what has changed in our forecasts is not the big picture but the short-term timing.

source

QE2: Copper bubble to expand and then explode with catastrophic results

Diposting oleh jim | 23.52 | News, Political Economy | 0 komentar »

Langganan:

Posting Komentar (Atom)

0 komentar

Posting Komentar